Harmony Bitspire runs a nonstop AI engine that tracks every market tick, filtering out blockchain clutter to deliver crisp, actionable signals in real time.

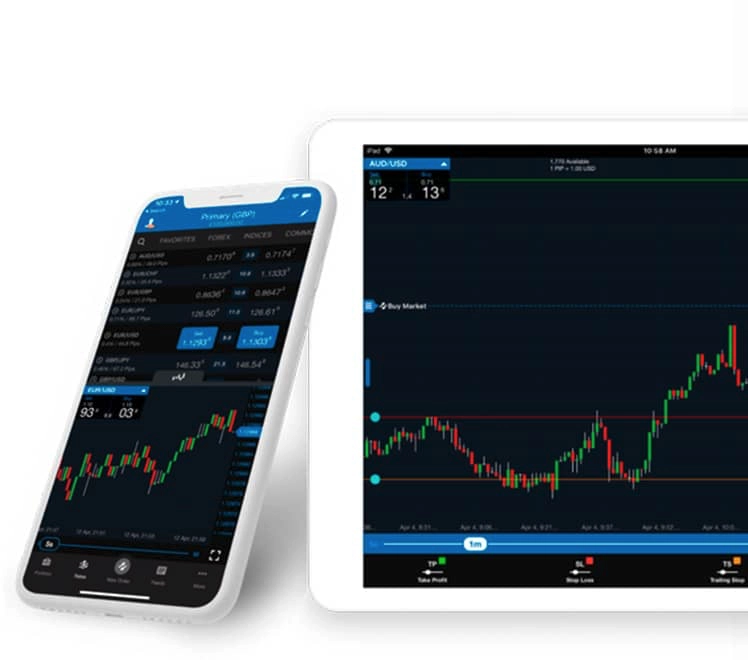

Modular dashboards transform dense data into intuitive visuals, and a built-in copy-trading lane allows users to follow expert moves—while staying in control. Its always-on monitoring catches global market shifts, even while you sleep.

The adaptive core of Harmony Bitspire updates its predictive models as new liquidity trends appear, refining accuracy with every cycle. Military-grade encryption and layered access controls at Harmony Bitspire secure your data with top-tier protection.

Different crowd-sentiment curves and liquidity feeds combine to form a single live panorama inside Harmony Bitspire. By highlighting flow vacuums, momentum bursts, and divergence pockets, proprietary sensors provide quick alerts that optimize entries, targets, and exits across a variety of digital assets.

Using Harmony Bitspire, traders get pinpoint clarity as neural engines decode order-book layers, volume spikes, and behavioral trends into direct, actionable insights. This refined intelligence empowers quick, confident portfolio decisions the moment the market changes.

The self-optimizing engine of Harmony Bitspire analyzes both historical and real-time blockchain patterns, anticipating sentiment fluctuations, resistance cracks, and liquidity spikes before mainstream charts do. While removing emotional noise, distilled notifications reduce reaction times.

Inside Harmony Bitspire, users access a tiered library of battle-tested trading strategies—designed so you can follow expert tactics without giving up control. Built-in analytics monitor every mirrored move, offering detailed feedback that helps sharpen your skills across weeks, months, and shifting market cycles.

By utilizing verifiable audit pathways, segregated vault storage, and robust encryption layers, Harmony Bitspire maintains the confidentiality of exchange credentials behind native firewalls and enables insights to flow through secure, read-only channels.

The specialized processors at Harmony Bitspire track momentum shifts, liquidity spikes, and depth-of-book imbalances, converting multi-venue feeds into concise prompts that cater to a range of risk profiles.

When structural changes occur, persistent models quickly issue notices by monitoring sentiment currents, transaction pacing, and cross-exchange order streams. By combining these datasets in a useful way, Harmony Bitspire enables portfolios to adjust their course before circumstances shift completely.

Harmony Bitspire delivers structured intelligence that removes the guesswork and supports intentional decisions. Its deep-learning framework filters massive data streams, highlighting patterns, gaps, and turning points. With Harmony Bitspire, traders gain a responsive, data-driven compass to navigate fast-moving global markets.

Harmony Bitspire uses an ultrafast inference core that adjusts with every market tick, adapting insights as conditions shift. Precision alerts highlight tokens worth watching and map ideal entry and exit points—helping traders refine timing and manage risk with confidence.

Self-adjusting algorithms within the platform create forward-looking context by combining live liquidity cues with historical order-flow archives. Constant retraining keeps guidance in sync with the dominant tempo by increasing sensitivity to momentum pivots, thematic triggers, and volatility bursts.

Harmony Bitspire continues to scan order books, news pulses, and sentiment waves continuously all over the world. Participants can quickly and confidently fine-tune exposure thanks to a distributed backbone that responds instantly to price shocks and handles data spikes without delay.

When problems occur, Harmony Bitspire experts provide succinct, prompt solutions that facilitate navigation, minimize downtime, and prevent annoyance. Users can move through each step with confidence thanks to detailed instructions on tool features and security settings.

Fueled by ultra-fast inference clusters, Harmony Bitspire sweeps through layered order-book depth, cross-exchange ticks, and sentiment threads in microseconds, exposing hidden liquidity cracks and sudden velocity spikes. Instant feedback converts raw price motion into precise entry points, position tweaks, and trend alignment—empowering both curious newcomers and seasoned crypto tacticians.

Instead of juggling countless browser tabs, users work inside Harmony Bitspire’s streamlined workspaces, where new opportunities and critical alerts flow in continuously. Machine-learning filters strip out market noise, spotlight tradable patterns, and showcase real-world playbooks from vetted strategists, enabling quick, self-directed action while preserving full control over personal tactics.

Security never takes a back seat: Harmony Bitspire layers end-to-end encryption, multi-factor verification, and routine audits to protect every record. Built-in learning modules guide beginners, while high-spec scanning suites satisfy experts. By pairing disciplined tools with structured mentoring, Harmony Bitspire promotes methodical participation.

Consistent progress in crypto starts with disciplined, repeatable routines. Harmony Bitspire offers a full range of planning modes—from fast-paced scalp strategies to slower, long-term frameworks—so your tactics can adapt as the market shifts.

At its core, Harmony Bitspire analyzes order-book depth and sentiment trends in real-time, projecting likely turning points and allowing you to compare strategies side by side. Instant feedback sharpens your trading style as both your goals and the market evolve.

While long-term directional builds are preferred by some traders, others thrive on quick breakouts. Harmony Bitspire provides context that corresponds to position length, liquidity requirements, and narrative flow for each individual objective by weighing both routes in real time.

Having defined boundaries encourages disciplined behavior. By highlighting reversal clusters, momentum ceilings, and sentiment shifts based on historical inflection points, Harmony Bitspire helps traders precisely position realistic targets and protective stops.

Deep learning circuits that detect minute structural changes before they appear on traditional charts are fed by continuous data streams. Dynamic heat maps and customized alerts enable quick recalibration, guaranteeing that guidance remains in line with the market's pulse.

Participants can access a wide range of studies through Harmony Bitspire, including RSI, Bollinger Bands, Keltner Channels, and Ichimoku zones. Each of these studies condenses complex motion into clear visual cues that highlight pressure points and directional bias.

Via Harmony Bitspire, traders gain access to a wide range of visual tools—like Stochastic Oscillators, Bollinger Bands, and Ichimoku clouds—that simplify complex price action into clear views of momentum, volatility, and trend direction. These visuals support multiple assets and timeframes, providing solid reference points for smarter planning.

Tight Bollinger squeezes can hint at major breakouts, Stochastic peaks often flag exhaustion, and Ichimoku shifts help define bullish versus bearish zones. When viewed together, these layers offer deeper market context than any single indicator alone.

Behind the scenes, Harmony Bitspire uses adaptive learning to fine-tune readings, filter out noise, validate longer-term signals, and send timely alerts—helping traders adjust positions as new trends emerge.

Harmony Bitspire offers a powerful analytics suite—featuring RSI, Keltner Channels, Fibonacci clusters, and more—to track fast-moving momentum shifts, liquidity zones, and directional trends across various assets and sessions. Each indicator is visualized clearly, helping traders make confident decisions in changing markets.

Keltner compressions hint at breakout potential, overstretched RSI levels flag caution, and Fibonacci overlap zones mark likely retracement points. Viewed together in Harmony Bitspire, these signals deliver a broader market view—ideal for sharpening entries and managing risk during volatility spikes.

Driven by machine learning, Harmony Bitspire scans these technical layers in real time, highlights key inflection zones, and sends focused alerts—allowing traders to adapt quickly as new patterns emerge.

Interest rate shifts, fiscal moves, and geopolitical shocks can ripple through crypto prices in seconds. Harmony Bitspire monitors treasury yields, commodity trends, and FX swings alongside real-time on-chain activity to detect early risk-on or risk-off shifts in digital assets.

Its adaptive AI analyzes every key macro release—jobs data, inflation reports, energy prices—by comparing them to past token reactions. The result? Live, color-coded dashboards that update as news breaks. Harmony Bitspire highlights pressure zones where tight liquidity, currency stress, or new stimulus might steer capital toward or away from decentralized markets.

By distilling global macro data into intuitive panels, Harmony Bitspire helps traders match big-picture forces with blockchain reality—keeping strategies aligned, structured, and agile through any market cycle.

Harmony Bitspire syncs real-time order book shifts with historical momentum patterns to spot the exact moment when buying or selling pressure takes over. Its speed-optimized AI then transforms those signals into actionable prompts—perfect for analysts timing research or setting precise entry orders.

Going deeper than the noise, Harmony Bitspire charts market cycles, breakout zones, and volatility corridors. This helps traders anticipate shifts, interpret evolving trends, and stay grounded—even in fast-moving conditions.

Positions that are carefully dispersed tend to foster long-term resilience. In order to maintain overall direction during difficult times, Harmony Bitspire provides AI-filtered allocation blends that align with liquidity rhythms, current momentum, and individual risk thresholds based on historical cross-asset behavior.

Granular signal layers within Harmony Bitspire eliminate background noise to reveal the initial cadence shifts in transactional velocity, sentiment, and depth. Responsive dashboards provide traders with quick, time-sensitive feedback so they can secure short-term adjustments before large swings occur. Losses are possible in the extremely volatile cryptocurrency markets.

Headline surges are typically preceded by subtle acceleration. Harmony Bitspire uses adaptive analytics to identify the first signs of energy, tracing sentiment spikes and liquidity channels that frequently portend long-term price growth. This helps with disciplined risk framing and strategic position sizing.

In the event of turbulence, Harmony Bitspire provides comparative diagnostics on swing magnitude, lifespan, and historical parallels, anchoring strategy in the face of volatile market phases and directing decisions toward structured judgment rather than reflexive reaction.

Harmony Bitspire combines lightning-fast neural processing with expert-level analysis, turning complex blockchain data, order book distortions, and sentiment shifts into clear, actionable insights. Its constant scans detect liquidity pressure points, volatility pulses, and behavioral pivots—giving direction that speaks to both data pros and newer analysts.

Inside Harmony Bitspire, dynamic dashboards track volatility trends, flag breakout pressure, and uncover hidden volume moves. Summarized views outline ideal timing zones, realistic targets, and repeated market patterns. With customizable alerts, flexible thresholds, and peer comparisons, Harmony Bitspire keeps your trading path structured—while you stay fully in control.

| 🤖 Enrollment Cost | Free of charge enrollment |

| 💰 Transaction Fees | No transaction fees |

| 📋 SignUp Procedure | Efficient and prompt registration |

| 📊 Curriculum Focus | Courses on Cryptocurrencies, the Forex Market, and Other Investment Vehicles |

| 🌎 Accessible Regions | Excludes USA, available in most other regions |